Managing your finances effectively is crucial in today’s fast-paced world. With the advent of artificial intelligence, you now have access to innovative budgeting tools that can help you track your spending, analyze patterns, and gain valuable insights into your money management.

You can now take control of your personal finance by automating tedious tasks and receiving personalized recommendations based on your unique spending habits. This comprehensive guide will introduce you to the best solutions available, helping you choose the right one for your specific financial needs and goals.

Key Takeaways

- Discover how AI is revolutionizing personal finance management through innovative budgeting solutions.

- Explore how smart tools can help you automate tasks and offer personalized recommendations.

- Learn about the key differences between traditional and AI-powered budgeting approaches.

- Find the best AI budgeting tools tailored to your financial needs and goals.

- Understand how these tools can benefit individuals, couples, and businesses alike.

Understanding AI Budgeting Tools

You’re probably familiar with traditional budgeting methods, but AI budgeting tools take it to the next level. As you explore the world of personal finance, understanding these tools can help you manage your money more effectively.

What Are AI Budgeting Tools?

AI budgeting tools are software applications that use artificial intelligence to analyze your financial data and help you manage your money more effectively. They can automatically categorize transactions, manage cash flow, and provide insights into your spending habits. By leveraging AI, these tools can process your financial information and identify patterns that might not be obvious to the human eye.

How AI Enhances Traditional Budgeting Methods

Traditional budgeting methods require manual tracking and categorization of expenses, which can be time-consuming and prone to errors. AI enhances these methods by automating many tasks, such as transaction categorization, and providing predictive analysis to help you achieve your financial goals. For instance, AI can analyze your past spending history to provide insights about your future cash flow, enabling you to make more informed financial decisions.

Moreover, AI budgeting tools can offer personalized recommendations by comparing your spending habits to others in similar financial situations, giving you valuable context for your budgeting journey. By using AI-driven budgeting tools, you can gain a clearer understanding of your financial situation and make more informed decisions about your money.

Key Benefits of AI Budgeting Tools

AI budgeting tools are revolutionizing the way you manage your finances, offering numerous benefits that make budgeting easier and more effective. By leveraging advanced technology, these tools provide a comprehensive financial management system that’s more efficient than traditional methods.

Real-Time Tracking and Insights

You can connect your bank accounts, credit cards, and other financial accounts to AI budgeting tools, allowing for real-time tracking of your spending. This connection gives you immediate insights into your financial transactions, helping you understand your spending patterns as they happen.

Automated Transaction Categorization

AI budgeting tools can automatically categorize your transactions, saving you hours of manual work. By intelligently sorting your purchases into categories like groceries, entertainment, and utilities, these tools help you apply budgeting rules such as the 50/30/20 rule more effectively.

Personalized Financial Recommendations

These tools deliver personalized financial recommendations based on your unique spending habits. By analyzing your financial data, AI budgeting tools can identify areas where you can cut back and save more effectively, providing you with actionable advice to improve your budget.

Predictive Analysis for Financial Planning

One of the significant benefits of using AI budgeting tools is their ability to perform predictive analysis. By forecasting your financial future, these tools can alert you before you exceed category limits or risk overdrafting your account, enabling proactive financial planning.

By combining real-time tracking, automated categorization, personalized recommendations, and predictive analysis, AI budgeting tools create a robust financial management system. This integrated approach helps you manage your finances more effectively, making it easier to achieve your financial goals.

Top AI Budgeting Tools for Personal Finance

When it comes to managing your finances effectively, leveraging the right AI budgeting tools can make all the difference. These tools not only help you track your expenses but also provide valuable insights into your spending habits, enabling you to make informed financial decisions.

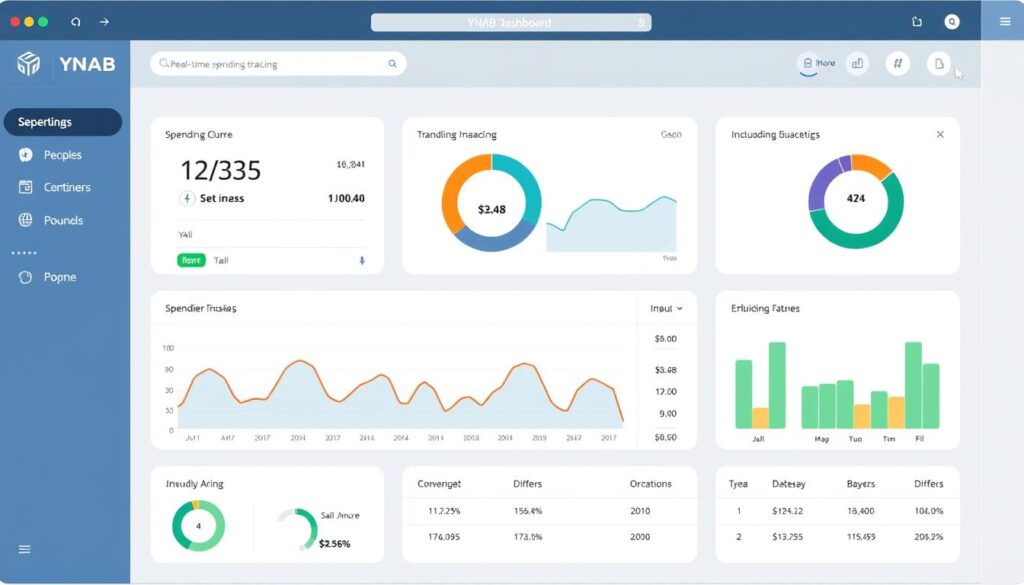

YNAB (You Need A Budget)

YNAB is an AI-powered budgeting tool designed to give every dollar a job. It helps you create personalized budgets, track spending in real time, and improve your financial habits.

Features

YNAB offers features like goal tracking, detailed reports, and automated savings. Its AI-driven insights help you understand where your money is going and adjust your budgets accordingly.

Pros

Personalized budgeting, real-time tracking, and improved financial habits are some of the key benefits. YNAB also offers educational resources to help you manage your finances better.

Cons

Some users may find the interface overwhelming at first, and there’s a learning curve to utilizing its full potential. Additionally, YNAB is a paid service, which might be a deterrent for some.

Mint

Mint is one of the most popular free AI budgeting tools available. It offers comprehensive features like tracking expenses, creating budgets, and alerting you when you go over budget.

Features

Mint uses AI to analyze your spending patterns and provides personalized tips to help you improve your finances. It also offers free credit score monitoring.

Pros

Mint is free to use, offers comprehensive financial tracking, and provides personalized financial advice. Its user-friendly interface makes it accessible to everyone.

Cons

Some users have reported issues with data accuracy, and the app can be cluttered with ads. Additionally, Mint’s customer support has received mixed reviews.

Cleo

Cleo is an AI-powered chatbot that assists you with budgeting, expense tracking, and savings. With its conversational approach, Cleo provides real-time financial advice and keeps you engaged with your money through casual conversations.

Features

Cleo’s conversational AI makes budgeting more engaging. It offers real-time financial advice and helps you set and achieve financial goals.

Pros

Cleo’s conversational interface makes financial management more approachable. It provides real-time advice and helps you stay on top of your finances.

Cons

Some users might find the chatbot’s personality too casual, and there are limitations to its financial advice. Cleo’s premium features require a subscription.

PocketGuard

PocketGuard helps you track your spending and see how much disposable income you have after accounting for bills, savings goals, and other essentials.

Features

PocketGuard’s “In My Pocket” feature calculates your available spending money, helping you avoid overspending. It also offers automated savings and investment tracking.

Pros

PocketGuard provides a clear picture of your disposable income and helps you manage your finances more effectively. Its automated features simplify financial management.

Cons

Some users have reported that the app can be overly simplistic, and there are limited customization options. PocketGuard’s premium features come at a cost.

Best AI Tools for Subscription Management

AI is revolutionizing the way you manage your subscriptions, making it easier to track and cancel unwanted services. With the help of AI-powered tools, you can take control of your finances and make informed decisions about your recurring expenses.

Trim

Trim is an AI-powered financial assistant that helps you save money by managing your subscriptions and negotiating bills. By analyzing your transactions, Trim identifies unwanted subscriptions and cancels them for you, while also providing recommendations for saving on bills.

Features

Trim’s key features include automated subscription tracking, bill negotiation, and personalized savings recommendations. These features work together to help you manage your finances more effectively.

Pros

Trim offers several benefits, including the ability to save money on bills, cancel unwanted subscriptions, and gain insights into your spending habits. By using Trim, you can simplify your financial management.

Cons

Some users may be concerned about the security of their financial data, and Trim’s bill negotiation service may not always result in the best possible outcome. However, Trim’s benefits often outweigh its drawbacks.

Emma

Emma is an AI-powered budget tool that helps you track expenses, manage subscriptions, and stay on top of your budget. By categorizing your spending and tracking subscriptions, Emma provides insights into where you could cut costs.

![]()

Features

Emma’s features include subscription tracking, expense categorization, and budgeting insights. These tools help you understand your financial situation and make informed decisions.

Pros

Emma provides a comprehensive view of your financial situation, helping you identify areas where you can cut back on unnecessary expenses. By using Emma, you can gain control over your finances.

Cons

Some users may find Emma’s features overwhelming, and the tool may require some time to learn. However, Emma’s benefits make it a valuable resource for managing your finances.

AI Budgeting Tools for Couples and Families

AI-powered budgeting tools designed for couples and families are revolutionizing how we manage household expenses and savings. These tools are tailored to help you and your partner or family members stay on the same financial page, making it easier to achieve your shared financial goals.

Zeta

Features

Zeta is an AI-powered budgeting tool that helps you manage joint expenses, track shared financial goals, and streamline household budgeting. With Zeta, you can automatically split bills, track expenses, and set savings targets together.

Key Features: Joint expense tracking, automated bill splitting, shared savings goals.

Pros

Using Zeta can significantly improve financial transparency and cooperation between partners or family members. It simplifies the process of managing shared expenses and working towards common financial objectives.

Advantages: Enhances financial collaboration, simplifies expense tracking, supports shared savings goals.

Cons

While Zeta offers numerous benefits, it may require both partners to actively engage with the app for it to be effective. Some users might also find the initial setup process to be time-consuming.

Limitations: Requires active participation from all users, initial setup can be time-consuming.

Goodbudget

Features

Goodbudget is based on the traditional envelope budgeting method, helping you allocate your income into different spending categories or “envelopes.” This approach allows for clear boundaries and structured spending.

Key Features: Envelope budgeting system, spending categorization, financial planning.

Pros

Goodbudget’s envelope system is intuitive and helps families manage their expenses more effectively. It’s particularly useful for those who prefer a more hands-on, visual approach to budgeting.

Advantages: Intuitive budgeting system, promotes structured spending, easy to track expenses.

Cons

Some users might find the envelope system too rigid or manual. Additionally, the effectiveness of Goodbudget depends on the users’ discipline in regularly updating their envelopes.

Limitations: Can be too structured for some users, requires regular updates.

Enterprise AI Budgeting Solutions

Enterprise AI budgeting solutions are revolutionizing financial management for businesses of all sizes. You’re likely looking for ways to streamline your financial operations, make more informed decisions, and drive growth. In this section, we’ll explore four cutting-edge AI budgeting tools designed to help you achieve these goals.

Cube

Cube is a powerful FP&A software tool that uses AI to analyze financial data and generate detailed “what-if” scenarios, helping you predict the financial impact of different strategic decisions. This cloud-based platform is particularly beneficial for growing businesses and enterprises.

Features

Cube’s key features include advanced financial modeling, automated data integration, and scenario planning. Its AI capabilities enable you to analyze complex financial data and make informed decisions.

Pros

Enhanced financial planning: Cube’s AI-driven insights help you create more accurate financial plans. Improved decision-making: The platform’s “what-if” scenarios enable you to assess different strategic decisions.

Cons

While Cube is highly effective, it may require significant setup and training for optimal use. Additionally, its advanced features may be more than what smaller businesses need.

Ramp

Ramp is a spend management platform that uses AI to streamline expense management, corporate card usage, and accounts payable. It verifies invoices, automatically categorizes receipts, and provides customizable spending controls.

Features

Ramp’s features include AI-driven expense tracking, automated accounts payable, and corporate card management. Its platform helps you maintain control over company spending.

Pros

Streamlined expense management: Ramp’s AI automates receipt categorization and invoice verification. Customizable controls: You can set spending limits and controls tailored to your company’s needs.

Cons

Ramp’s fees may be a consideration for very small businesses. Additionally, the transition to Ramp’s platform may require some adjustment from employees.

Xero

Xero is an accounting software that leverages AI to help small businesses manage their financial operations. It features automated bank feeds, invoicing, and expense tracking, along with AI-powered Analytics Plus for predicting future cash flow.

Features

Xero’s AI-driven features include automated bookkeeping, invoicing, and financial reporting. Its Analytics Plus tool provides predictive insights into your cash flow.

Pros

Automated financial tasks: Xero’s AI automates tasks like bank reconciliations and invoicing. Predictive cash flow management: Analytics Plus helps you anticipate future financial needs.

Cons

While Xero is user-friendly, its more advanced features may require some accounting knowledge. Additionally, costs can add up as you expand your use of its services.

Anaplan

Anaplan is a cloud-based financial planning platform that supports large enterprises in managing planning processes across finance, supply chain, sales, and HR. It enables real-time collaboration within custom dashboards.

Features

Anaplan’s features include real-time data integration, customizable dashboards, and collaborative planning tools. Its platform integrates financial and operational planning.

Pros

Real-time collaboration: Anaplan enables teams across departments to work together in real-time. Integrated planning: The platform connects financial and operational planning in a single system.

Cons

Anaplan is a comprehensive platform that may require significant investment in training and implementation. Its complexity may be overwhelming for smaller businesses.

AI-Powered Financial Forecasting Tools

Financial forecasting just got a whole lot smarter with AI-driven tools designed to help you plan for the future. You’re likely no stranger to the importance of budgeting and financial planning, but AI-powered forecasting takes it to the next level by analyzing your current financial patterns and predicting future outcomes.

Monarch Money

Monarch Money offers a comprehensive platform that combines budgeting, financial planning, and investment tracking in one place. This AI budgeting tool provides you with a detailed analysis of your financial health and facilitates personalized budgeting insights.

Features

Monarch Money’s features include automated transaction tracking, investment monitoring, and personalized financial recommendations. These features help you stay on top of your finances and make informed decisions.

Pros

The pros of using Monarch Money include its comprehensive financial overview, ease of use, and AI-driven insights that help you optimize your financial planning.

Cons

Some users might find the features overwhelming at first, and there’s a learning curve to fully leveraging its capabilities.

Wally

Wally is another powerful tool that uses AI to help you track expenses, plan your budget, and set financial goals. Its AI capabilities enable you to monitor your spending and receive insights on how to achieve your financial targets.

Features

Wally’s features include real-time budget updates, receipt scanning, and AI-driven financial goal setting. These features make it easier to stay on track with your financial objectives.

Pros

The pros of Wally include its user-friendly interface, real-time tracking capabilities, and actionable insights that help you manage your finances effectively.

Cons

Some users might find the receipt scanning feature sometimes inaccurate, and the app might not be as comprehensive as some other financial tools.

Planful

Planful is a cloud-based financial performance management software that supports financial planning, budgeting, and consolidation. It uses AI to automate processes like month-end close and scenario planning, making it a robust tool for businesses.

Features

Planful’s features include automated forecasting, financial reporting, and AI-driven scenario planning. These features help businesses streamline their financial planning and make more accurate predictions.

Pros

The pros of Planful include its ability to automate complex financial processes, provide predictive insights, and support comprehensive financial planning.

Cons

Planful might be more than what individual users or small businesses need, and its pricing could be on the higher side for some.

Privacy and Security Considerations

As you explore AI budgeting tools, it’s crucial to consider the privacy and security implications of sharing your financial data. While these tools can simplify financial management, they require careful consideration of data protection and security measures.

Data Protection in AI Budgeting Tools

AI budgeting tools handle your personal financial information with varying levels of data collection, storage, and access. It’s essential to understand what data is being collected and how it’s being used. Most reputable companies have industry-standard security and privacy policies, but no system is completely immune to data breaches.

When evaluating AI budgeting tools, consider the following:

- What data do they collect, and how is it stored?

- Who has access to your financial information?

- How do they protect your data from unauthorized access?

| Feature | Description | Importance |

|---|---|---|

| Data Encryption | Protects your data with encryption | High |

| Multi-Factor Authentication | Adds an extra layer of security to your account | High |

| Regular Security Audits | Ensures the security measures are up-to-date and effective | Medium |

Best Practices for Secure Financial Management

To minimize your exposure to potential security risks, follow best practices for secure financial management. This includes opting for multi-factor authentication (MFA) whenever possible and regularly reviewing your account activity.

When using AI budgeting tools, make sure to:

- Read the privacy policies and terms of service agreements carefully.

- Understand how your data is being used and shared.

- Monitor your bank accounts regularly for any suspicious activity.

By being informed and taking proactive steps, you can enjoy the benefits of AI budgeting while protecting your financial information.

How to Choose the Right AI Budgeting Tool

Finding the perfect AI budgeting tool requires understanding your financial goals and preferences. With so many options available, it’s essential to have a systematic approach to selecting the right one for your needs.

Assessing Your Financial Needs

To choose the right AI budgeting tool, you first need to assess your financial needs. Consider your financial goals, such as saving for a big purchase or paying off debt. Think about your spending habits and what features are must-haves for you. For instance, if you have multiple subscriptions, you might prioritize a tool with robust subscription management features.

You should also consider your comfort level with technology and the level of support you might need. Some AI budgeting tools offer more user-friendly interfaces and customer support than others.

Comparing Features and Pricing

Once you’ve identified your financial needs, it’s time to compare the features and pricing of different AI budgeting tools. Look for tools that offer the features you’ve identified as must-haves. Be sure to check the pricing models, as they can vary significantly. Some tools are free, while others require a subscription or a one-time payment.

When evaluating pricing, consider the value you’ll get from the tool. A more expensive tool might be worth it if it helps you save money or achieve your financial goals more effectively. Experimenting with a few different apps through free trials or basic versions can help you find the one that best fits your needs and budget.

The Future of AI in Personal Finance Management

With AI-powered budgeting tools, you’re about to experience a significant shift in how you manage your money. AI is not just enhancing traditional budgeting methods; it’s revolutionizing the way you think about personal finance management.

As AI continues to evolve, you’ll gain insights into how AI technology is rapidly changing the landscape of budgeting tools. Emerging trends in AI finance applications include more sophisticated predictive analytics, deeper personalization, and integration with other financial services. This means you’ll be able to anticipate your financial needs before you even recognize them yourself.

AI tools are enhancing rather than replacing human financial management. They automate tedious tasks, allowing you to maintain control over important financial decisions. By understanding how these technological advances might impact your financial health, you can position yourself to take advantage of these innovations.

In the coming years, AI will play an even more significant role in helping you stay agile and responsive to change. By embracing AI-powered budgeting tools, you’ll be better equipped to manage your money and achieve your financial goals.